Have You Aced Your Retirement?

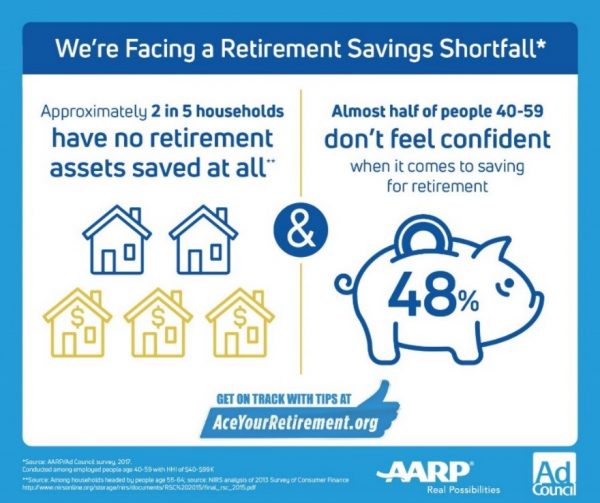

Life tends to flash before our eyes before we even realize it. One day you are 20 and the next day you wake up and you are already in your 30’s. And as if being an adult wasn’t hard enough, there are so many things that you have to think about as you age. For me, it was serving my country and then my career, and for many, it is that or college and career. The list of things we have to manage as adults is a lengthy one. Many of those things, such as retirement, we sometimes put off thinking about a lot longer than we should.

As with most things that feel completely overwhelming, such as retirement, we often procrastinate hoping that at some point it will get easier. And I hate to be the bringer of bad news, but it won’t get easier and the longer you neglect to think about it, the harder it may be!

One of my biggest fears is not having enough for retirement. Did I save enough? or what will happen when I get older? Everyone should expect to have these fears. Be sure you are ready, and research as much as you can. ~Tom

Thankfully, in this wonderful age of internet and technology, help is just a click away. Pop over to AceYourRetirement.org and get personalized, simple tips on how to jumpstart your retirement savings and make sure you are on track. You never know, you may be surprised at how simple it is to get yourself motivated once you open it up and take that first step.

Using AceYourRetirement.org was a huge help for me. It showed me a couple steps I could take today to help make sure that I am on track for a more secure financial future. There are tools you can use to determine if you are doing enough. Playing catch-up can be difficult. Be ready.

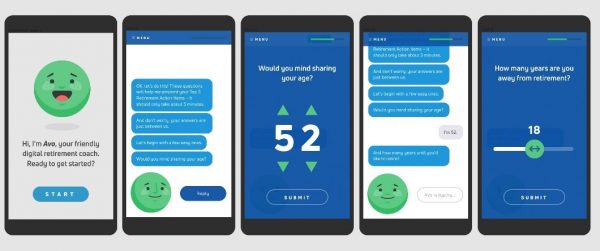

For example: Thanks to Avo, the friendly digital retirement coach, I double-checked to make sure that we were maxing out our 401K and we found out we needed to adjust our contributions slightly. It was only $25 more per paycheck, but it can pay off bigtime down the road.)

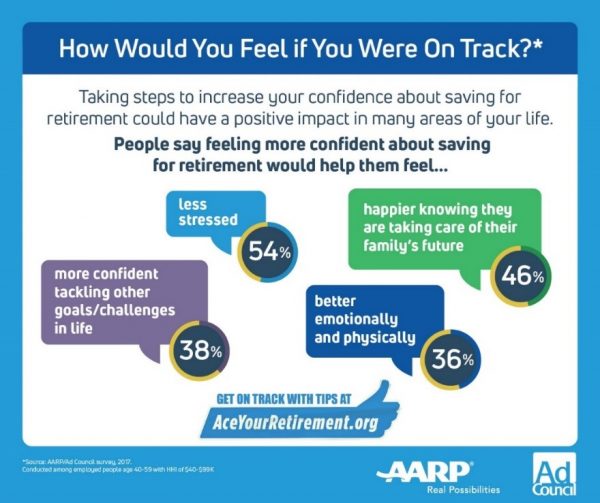

There are many things in life that you virtually have no control over. So, when there are things, such as planning for retirement, that you can take control of, we should make it happen! Once you do take that daunting first step, you are making a positive impact in securing a future for yourself and for your family.

According to a recent survey from AARP and the Ad Council, more than half of people in their 40s and 50s say that feeling more confident about saving for retirement would help them feel less stressed (54%). And 46% would be happier knowing they are taking care of their family’s future.

Thankfully, we’ve been savvy with our money and make sure we don’t allow ourselves to get into debt. But even still, I know I feel more confident after chatting with Avo at AceYourRetirement.org. And, you cannot use the excuse that you are too busy because it literally only took about 3 minutes to learn so much! Don’t you want to have the confidence in your future instead of the stress of not knowing what is to come?

Here are a few tips to consider to help you maximize your retirement savings:

- While gathered with your family for the holidays, discuss your savings plans and retirement goals, and what you can do today to achieve them. It’s important for everyone in the family to be on the same page about your financial goals and priorities.

- Start planning now what age you plan to retire and when you plan to start taking your Social Security benefits. Earning a few more years of income could really help you grow your nest egg, and delaying when you start collecting Social Security increases your annual benefit.

- If your employer offers matching funds for your retirement savings plan, make sure you’re contributing at least enough to get the full employer match.

- Brainstorm ideas for earning money in retirement, such as turning a hobby into a source of income, or taking on seasonal part-time work

- Visit AceYourRetirement.org to get your personalized action plan in just three minutes. Your digital retirement coach, Avo℠, will reveal the top three simple, practical things you can do right now to make sure your retirement plan is on track.

Where will you start with your retirement planning? What’s your biggest challenge today?

Disclosure of Material Connection: I have not received any compensation for writing this post. I have no material connection to the brands, products, or services that I have mentioned. I am disclosing this in accordance with the Federal Trade Commission's 16 CFR, Part 255: "Guides Concerning the Use of Endorsements and Testimonials in Advertising."

Discover more from Tom's Take On Things

Subscribe to get the latest posts sent to your email.

This sounds great. I didn’t do so well with my retirement savings. We all really need to think about this. Thank you so much for sharing. God Bless

I need to save more for retirement. I don’t even have anything in a 401k. These tips are a good start.

Great ideas.

Very excellent tips for acing retirement…something that I still need to work on…and it will be done…

OH boy, I wish!! I am years away from retirement! All these tips are great though!